Nose hair is offensive. A tax on property is like the nose hair of public policy. There may not be a more offensive tax – well, maybe a tax on breathable air, but let’s not give big government any ideas.

Here are the three most nose hair-ish things about the property tax:

- The tax turns owners into renters: Let’s say you own your home (after 30 years of mortgage payments) and refuse or are unable to pay property tax on it; what happens? That’s right, the government takes your home. So, are you paying tax or rent? When failure to pay means loss of ownership (seizure), then the tax is merely rent. People of a free country (and of a free state) are endowed by God with the right to life, liberty, and property. Because taxation with a threat of seizure becomes a form of rent, then the right to the property is abolished. Instead, it’s more like an entitlement granted by the grace of government, and revocable via a sufficiently onerous tax. A property tax abolishes the right to property.

- Taxes on unrealized gains: Not so long ago, a certain candidate for President suggested taxing the unrealized (not cashed in) profits of holders of stock and other financial assets. The intent was to extract money from people who are becoming wealthy, but haven’t sold the assets to receive the profits of the higher values. That candidate was roundly criticized for suggesting taxing ethereal, unrealized wealth. Few acknowledged that we already do the same thing with property taxes on home ownership. Because property taxes are assessed on the “current market value” of the home, higher home prices lead to higher taxes on those unrealized gains supposedly possible from selling off the home.

- Everyone needs a home: Back to our God-given rights. A property tax on a home replaces the right to life with a government-granted (or revoked) privilege to live. Government replaces God. We are endowed by our Creator with inalienable rights, among which are life, liberty, and the pursuit of happiness. The right to life, to be effective, must include the right to acquire and utilize the necessities of life, such as food, clothing, shelter, etc. Removing or threatening the ability to acquire and keep any of these, a home, for example, is an affront to one’s right to live and be free. Property taxes defy the rights of the people.

Good news! We can remove the nose hair

Eliminating the tax on property may be easier than you think. In fact, a couple of steps in the process are already in effect. Did you know that in two years, legislation was passed to ease property taxes? The bill (House Bill 292) in 2023 did not specifically cut property tax rates, but limited spending by local school districts, and created distributions to those districts by up to $355 million to allow them to cut property tax collections. The second bill (House Bill 521) in 2024 allocated money to districts to assist in the paying down of bonds and levies, thereby reducing the burden on property owners.

Neither of the measures required higher state sales or income taxes to accomplish the goals; instead, the state utilized the natural growth in sales and income taxes. In fact, the 2024 bill included income tax reductions along with the distributions.

This is the formula for eliminating property taxes in Idaho. Take the natural growth in sales and income taxes at the state level, and allocate the money to local governments in lieu of their collecting that amount of property taxes. Within 6 to 7 years of such replacement, the growth in sales and income taxes will facilitate enough allocations to offset the entire amount of property taxes being paid for local government and school districts.

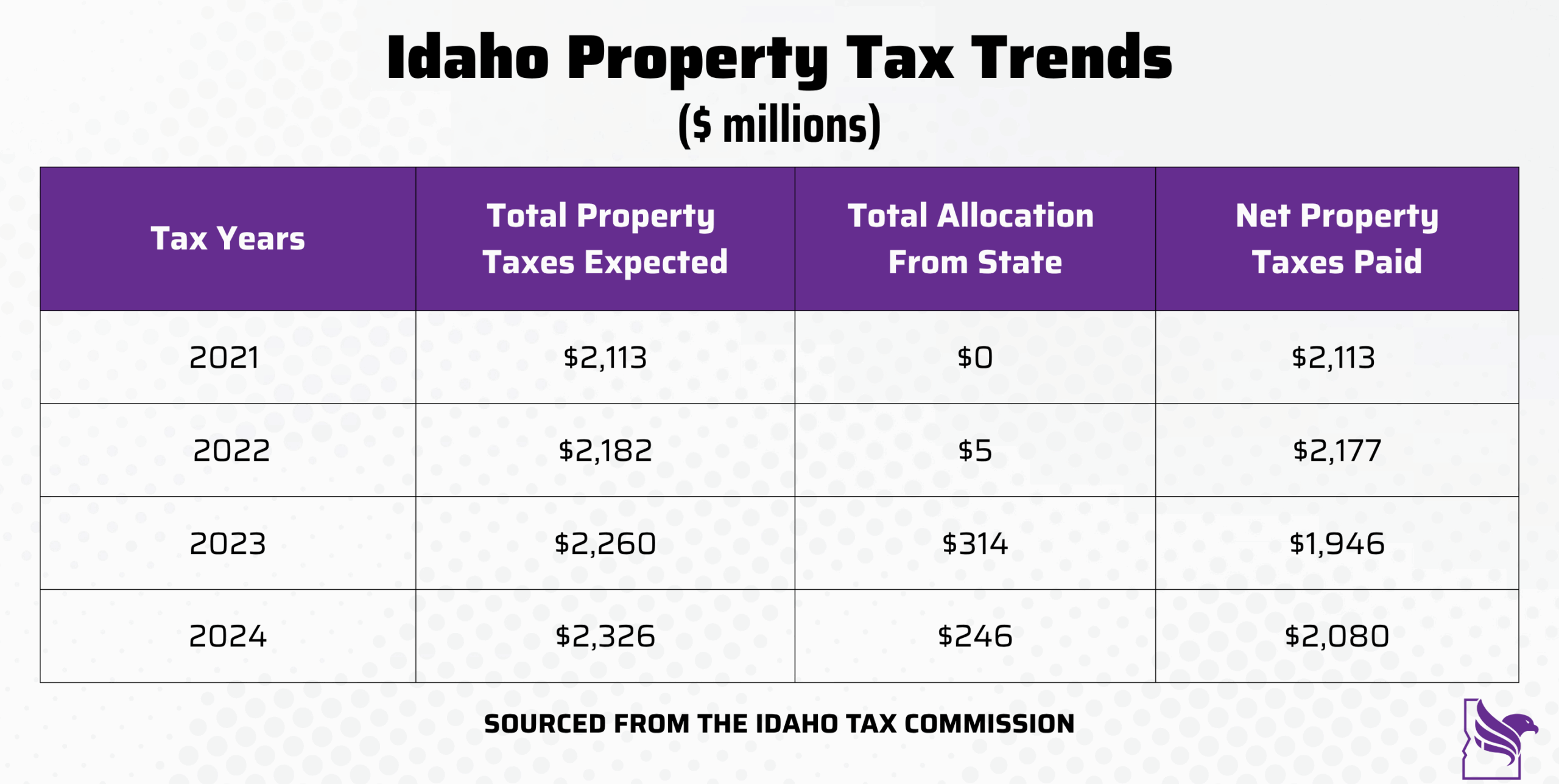

For example, here is actual data from the last few years of property taxes expected at the local level, replaced by state allocations, and the remaining taxes still collected from property owners.

Do you see how the state allocation reduced the net property tax payments by owners? Property owners paid less in property taxes in 2024 than they did in 2021. If Idaho lawmakers made even greater efforts at cementing this as the plan, perhaps $400 million per year dedicated to property tax replacement, then within six years, all property taxes could be abolished.

All Idaho needs to do is continue to build on this process. Limit the growth in local government growth and spending, increase the allocations from the state to the local governments, eventually get the “Net Property Taxes Paid” to zero, and finally eliminate all property tax references in state statutes. Presto! Idaho homeowners are owners again, and Idaho has led the way to become the first state with ZERO PROPERTY TAXES!

The Idaho Freedom Foundation is leading out on this effort. With your help, we can work towards eliminating property taxes altogether.