There is no doubt that Minnesota has a fraud problem, which, in itself, is disturbing. However, in the backdrop of a persistent and widening structural budget deficit, the consequences of that fraud are even more significant. As legislators look to address the state’s worsening fiscal outlook in the 2026 session, the role of fraud in raising state spending could come under scrutiny.

So, how much has fraud contributed to the state’s structural budget deficit?

By its nature, fraud is usually only uncovered after it has occurred. As First Assistant U.S Attorney Joe Thompson explained, like with virtually any crime, law enforcement “prosecutes backwards.” Fraud, therefore, creates a double impact: it prevents accurate spending estimates and distorts the resulting budget decisions.

How fraud shows up in the budget forecast: Medicaid

Medicaid is one of several major ‘forecasted’ Health and Human Services (HHS) programs, which the Minnesota Management and Budget (MMB) must provide spending estimates for. To create these estimates, MMB generally relies on past and present spending, which is, in turn, influenced mainly by:

- Number of enrollees

- Service Utilization (which services and how much of each service enrollees use)

- Cost of services

- Administrative costs

Assuming that current laws remain as is, MMB uses past trends and future expectations to estimate each of the above factors and then impute spending numbers. Enrollment, for example, depends on the state’s eligibility standards and the economy. When the economy is doing well, fewer people experience economic hardship. As a result, fewer applicants also qualify for Medicaid, and vice versa.

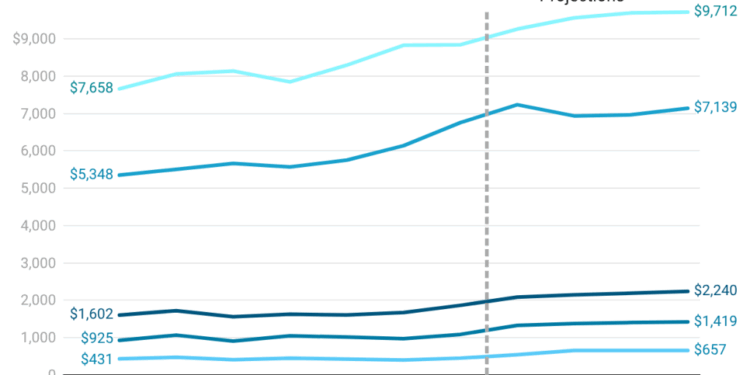

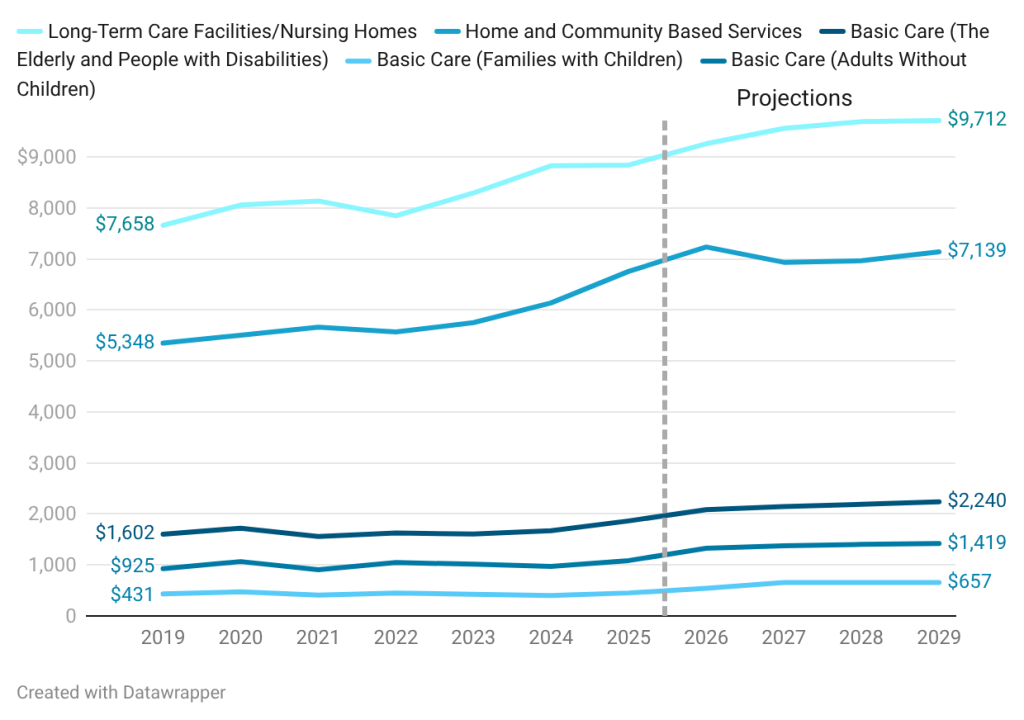

Service utilization can vary among various enrollees as well. The elderly and people with disabilities, for instance, use more and costlier Medicaid services. In the November 2025 forecast, the Department of Human Services (DHS) estimates that basic care (the health insurance side of Medicaid) will cost $2,240 per aged or disabled enrollee in 2029. This is over three times the cost per person in the families with children group ($657).

Long-term care services (utilized by the elderly and people with disabilities) are the most expensive. Nursing care facilities, for example, could reach $9,712 per month per enrollee. This is over four times the cost of basic care for the same group. Home and Community-Based Services, or long-term care waiver services (which account for a large chunk of the various high-risk programs), could reach $7,130 per enrollee per month, over three times the cost of basic care.

Figure 1: Actual and Projected Average Monthly Spending on Medicaid per Enrollee, Total Funds (2024 $)

Fraud affects the budget by artificially raising enrollment, utilization, and the cost of services. If people who would otherwise not be eligible for Medicaid enroll in the program fraudulently, baseline enrollment rises. Consequently, MMB will estimate a higher enrollment for the future.

Or in some cases, fraudsters can bill for services that they never provided. This is common with long-term home and community services, such as the Housing Stabilization Services (HSS) Program — a program that has been cancelled due to rampant fraud. Billing for services never rendered artificially raises utilization rates, leading to higher spending estimates.

Fraudsters can also overbill for services, making it appear as though enrollees are utilizing more costly services than they actually are. This artificial demand for pricier services gets reflected in future estimates.

This is why, when asked what role fraud plays in the November 2025 forecast, MMB Commissioner Erin Campbell explained that,

…to the extent that it is driving spending increases, it would show up in the increased spending in forecasts.

Planning requires accurate forecasts

In the 2026-27 biennium, Minnesota has a $2.2 billion structural deficit. This gap grows into over $4 billion in the 2028-29 biennium. Fraud, even if it is part of this deficit, won’t show up as a line item for legislators to cut.

Compounding this, as lawmakers ponder what programs to cut to align revenues with spending, fraud threatens to undermine the process by casting doubt on the integrity of programs that serve vulnerable Minnesotans.

Unless legislators take efforts, as Thompson explained, to “shut off the faucet of funds that are flowing out to these fraudulent entities,” the legitimacy of budget estimates, especially for Medicaid’s home and community-based services, will remain in question, making it difficult to plan accurately for the future.