Inflation

Today, the Bureau of Labor Statistics (BLS) announced that:

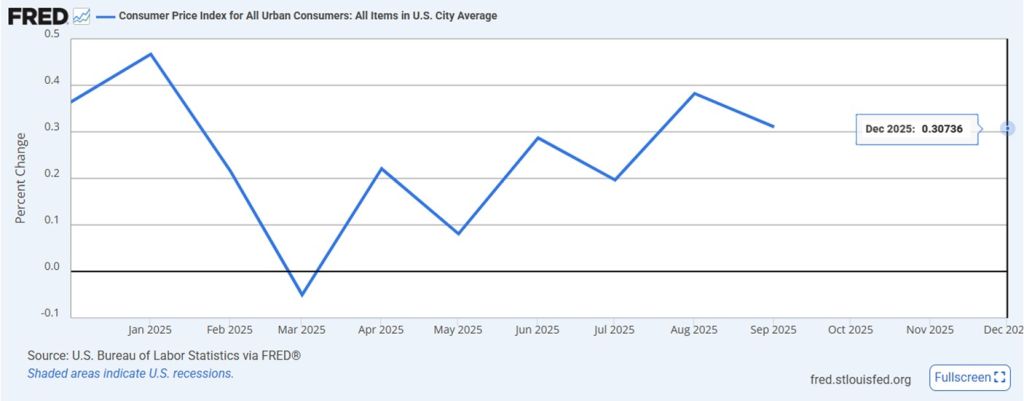

The Consumer Price Index for All Urban Consumers (CPI-U) increased 0.3 percent on a seasonally adjusted basis in December…. Over the last 12 months, the all items index increased 2.7 percent before seasonal adjustment.

As Figure 1 shows, this is down from August and September, but still above any other month since last January. It is consistent with a 3.7% increase in the CPI from January to January, so inflation remains elevated.

Figure 1

As Figure 2 shows, the annual rate of inflation exploded from 1.3% in January 2021 to 9.0% in June 2022. What it also shows is that since this rate moderated in June 2023, it has averaged 3.0%, 50% up from the average rate of 1.9% during the period before the surge, January 2017 to January 2021.

Figure 2

It is, as I have argued before, still too early to be talking about interest rate cuts. The fact that inflation was allowed to get out of control doesn’t mean it should be allowed to remain out of control. That was the lesson painfully learned under Paul Volcker and Ronald Reagan.

Affordability

We are stuck, it seems, in a higher inflation world. Perhaps this is what lies behind American’s concerns about “affordability”?

An important piece of data here is real wages, so wages adjusted for inflation. If your wage increases in nominal terms at less than/the same as/more than the rate of inflation, your wages will be lower/the same/higher in real terms of purchasing power, what that wage can buy you.

The BLS also released data today on Real Earnings. “Real average hourly earnings for all employees were unchanged from November to December,” the BLS reports:

This result stems from an increase of 0.3 percent in average hourly earnings combined with an increase of 0.3 percent in the Consumer Price Index for All Urban Consumers (CPI-U).

What is the longer run story on real wages?

Figure 3 shows the nominal wage adjusted for inflation to give the real wage stated in December 2025 dollars. It also shows the year over year change. We see the real wage chugging upwards from January 2017 to February 2020 at an average annual rate of 0.8%. Then we enter the COVID-19 pandemic and, between March 2020 and June 2023, real wages soar, plunge, and recover. In the period since June 2023, the real wage has been chugging upward at an average annual rate of 1.0%, better than before the pandemic.

Figure 3: Real wages and change

So why are people so cheesed off?

Maybe you think the data is cooked and maybe it is, but I don’t know on what other basis we have this discussion fruitfully. Besides, many of the people who tell me this were quoting the same data as scripture when it showed a massive spike in inflation and collapse in real wages in 2020-2022.

More likely, I think, is that your average American doesn’t think about inflation in the same way that economists or financial columnists do, and who can blame them? Figure 4 shows that the CPI — the price level — rose by 15.4% between May 2020 and June 2022, the largest increase over such a period since November 1982. When people think about inflation going down, most, I think, are referring to this price level declining when most economists are referring to the rate of increase in the price level declining, as seen in Figures 1 and 2. But, while this rate of increase might come down, that price level is very unlikely to ever return to the level of May 2020.

Figure 4

The price level is way up on what it was a few years ago and that has occurred after a long period where inflation was relatively muted. People pick up milk or meat, or they look at how much it costs to fix their car or how much they’re paying for shin guards for their kid’s soccer class, and they think “Wow, that’s a lot more than it used to be.” And, generally speaking, they are right. That, I think, is the source of the current economic grumpiness in America, and it isn’t wrong. The economist telling these folks that inflation is down because the month to month rate of increase is down — and it is still 50% over target, as it goes — doesn’t cut much ice.

Maybe Americans will start to feel better as the Great Inflation of 2020-2022 recedes in their memories and those real wage increases in Figure 3 start to dominate their mental landscape. Whether they do or not will be a big factor in elections in November.