Today’s math riddle is brought to you by Johnson County school superintendents: How can taxpayers give school districts hundreds of millions of dollars more for special education without increasing total spending or cutting other state funding?

The obvious answer is that it’s not possible, but that is what they tell taxpayers, and in their pitch for more funding during a recent meeting with legislators.

I asked them to explain their calculations, but none of them responded to my email. I wasn’t in the meeting with legislators, but I hope the Johnson County delegation asked the superintendents a lot of questions.

Like, how do you explain not having enough money when you haven’t spent all of the funding you received over the last 20 years?

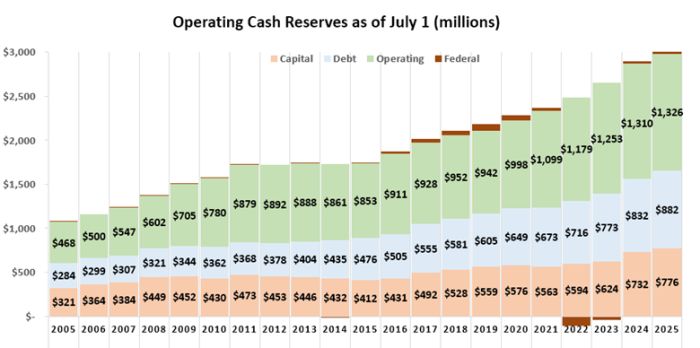

Operating cash reserves for the six Johnson County districts increased from $94 million to $227 million over the period, excluding reserves for capital outlay, debt payments, and federal funding. The same is true of districts across Kansas, with operating cash increasing from $468 million to $1.33 billion as of July 1, 2025.

Legislators may also have asked the superintendents why they claim that transferring general education funding to special education is causing students to be underserved, given the substantial funds left over from prior years. Is it because increasing cash reserves is a higher priority than educating students? Or are they just hoping that legislators and taxpayers won’t notice?

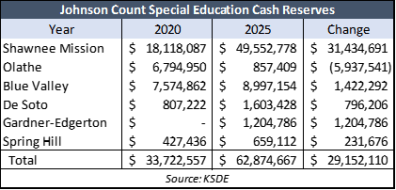

Special Education cash reserves, which are included in the operating reserve totals, also increased for most Johnson County school districts. Legislators hopefully asked them to explain the enormous variances across the county.

For example, why did Shawnee Mission’s cash balance jump from $18 million to $49 million over the last five years while Olathe’s $6.8 million balance nearly evaporated? And why does Shawnee Mission hold $49 million in reserve, when some Kansas districts have zero balances?

For example, why did Shawnee Mission’s cash balance jump from $18 million to $49 million over the last five years while Olathe’s $6.8 million balance nearly evaporated? And why does Shawnee Mission hold $49 million in reserve, when some Kansas districts have zero balances?

In fact, eight Kansas districts had zero special education balances at the beginning of the 2025 school year, including neighboring Kansas City, Kansas. Another 36 districts had less than 10% of the coming year’s expenses in the bank, so the districts’ own behavior indicates that large special education cash reserves aren’t necessary.

By the way, Special Education cash reserves for all districts set a new record of about $260 million, up about $20 million from last year. Special Education Co-Ops held another $21 million in reserve.

The superintendents say they had to divert discretionary funding from general education students to fund special education, but why would they transfer more than is needed? If they only transferred enough to cover alleged special education shortfalls, the fund balances would be the same at the beginning and the end of the year. The table shows all but Olathe transferred more than was necessary.

Is it because building cash reserves is more important to them than meeting educational needs? Did they hope no one would notice? Are Shawnee Mission board members even aware that at least $31 million was unnecessarily transferred to special education over the last five years?

Are Johnson County superintendents gearing up to sue taxpayers for more money?

Johnson County superintendents also dropped a hint that school districts are gearing up to sue taxpayers for money again, alleging that general education isn’t fully funded.

The Kansas Supreme Court ruled in 2019 that school funding met its definition of adequate funding, after the Legislature submitted a plan to increase base state aid and special education funding. The Legislature said it would increase special education funding by $44 million in the first year and then provide $7.5 million more each year. Legislators not only kept their promise but also exceeded what was included in the court settlement.

The Legislature should have eliminated a statutory provision dealing with special education funding because the court settlement rendered it moot, but since that hasn’t taken place, some school districts say the old special education funding clause still applies, and they use that as their premise to use your tax dollars to sue you for more of your tax dollars.

You read that correctly. School districts divert some of the tax dollars you provide for educating students to pay their attorneys to sue you.

For the record, every district needs some cash reserves, but many have far more than necessary. Dozens of districts have less than 12% of the coming year’s expenses in the bank every year. Those districts do a much better job of cash management, and they could probably teach the Johnson County districts a thing or two about math, also.