Center of the American Experiment’s Bill Glahn reported recently on the public hearings for Xcel Energy’s electricity rate case. The Minnesota PUC is holding hearings through September 25 in locations around the state.

With the opportunity open to comment on this rate case, Minnesotans might be wondering: what is a “rate case,” anyway, and why should it matter to me? How do utilities set rates, how do regulators review them, and how can the public participate? While this week’s hearings are specific to Xcel, understanding rate cases is essential for anyone who pays an electricity bill in Minnesota.

The perverse incentives behind utilities profits

In Minnesota, investor-owned utilities like Xcel Energy are granted a government-approved, vertically integrated monopoly for an exclusive service territory. Since retail customers can’t bring their business elsewhere, the state regulates the utilities’ rates and operations. The Minnesota Public Utilities Commission allows utilities to charge enough for electricity to recover their costs and earn a regulated profit called “Return on Equity,” typically between five and 10 percent of capital investments in infrastructure and equipment. These costs are built into the rate base.

ROE means that utilities are guaranteed a profit margin on whatever they spend, so long as regulators approve it, which gives them a strong incentive to build and invest beyond what is necessary to maintain reliability. This leads to “green plating” the grid as utilities make inefficient investments to build the massive amount of wind and solar needed to meet state-level mandates and continue to keep the lights on. Guaranteed profits also incentivize utilities to retire reliable, paid-off power plants because once they are fully depreciated, they don’t make profit from the facility.

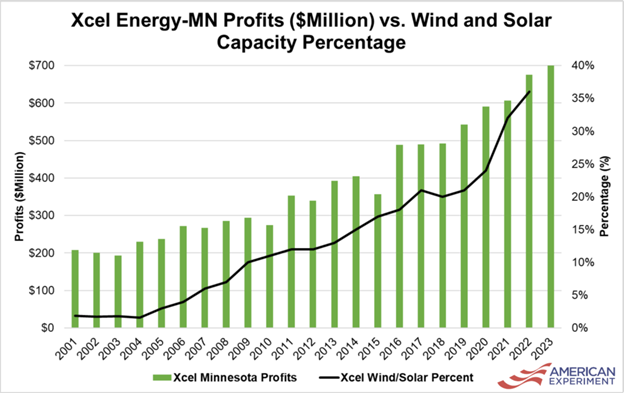

Work from American Experiment’s former energy policy fellows Isaac Orr and Mitch Rolling shows how green plating has inexplicably turned Xcel Energy into a growth stock:

“From 2001 to 2007, before the renewable mandates were enacted, profits for Xcel Energy in Minnesota grew by an average of 2.9 percent per year. Since 2007, profits have grown by 115 percent, increasing by an average 7.6 percent per year, driven largely by renewable energy investments.”

Xcel acknowledges in an information sheet on its 2025-2026 rate case that the funds are needed to reinforce “our continued transition to more renewable energy generation” and support plans to “add more wind and solar energy” and “add battery energy storage systems.”

In other, wholly unrelated news, Xcel Energy surpassed expectations in Q2 2025, “with earnings per share reaching $0.75, surpassing the anticipated $0.66. The company’s revenue also exceeded expectations, coming in at $3.29 billion compared to the forecasted $3.23 billion.”

How does the PUC decide what rates are “reasonable?”

A rate case is a formal request by a utility — like Xcel Energy or Minnesota Power — to raise the rates it charges customers. When a utility wishes to raise rates, it submits a proposal to the PUC, which is a board of five commissioners appointed by the governor to regulate utilities. The PUC reviews the rate case, often with input from the Department of Commerce, which nominally represents the ratepayer.

Xcel Energy is currently guaranteed 9.25% ROE and is asking for 10.3% in its open 2025-2026 rate case. Nearly a third of Xcel’s total request ($144 million annually) is due to this requested increase in the company’s authorized return, not just utility infrastructure like adding more wind and solar to the grid. Xcel’s request would raise electric rates by 9.6% in 2025 and another 3.6 percent in 2026, or a 13.2 percent increase over two years.

After a rate case is formally filed by the utility, an administrative law judge oversees hearings, collects evidence, and hears testimony and comments from utilities, advocates, and the public. The PUC makes a formal decision after public input to approve, deny, or modify the request.

While the rate case is pending, the PUC can authorize an interim rate increase. For Xcel’s 2025-2026 case, beginning January 1, 2025, ratepayers saw a $192 million increase in interim rates. The increase effective at the beginning of this year explains rising bills this year even while the case is being decided.

How to get involved in rate cases

Parties with a direct interest in the outcome of the case can formally intervene as “intervenors,” which are typically large businesses that consume substantial electricity, advocacy groups, or municipal utilities or cooperatives. Intervenors can submit testimony and evidence, cross-examine witnesses, and make legal arguments.

However, anyone can submit public comments. For the Xcel Energy rate case, written comments are due by December 30, 2025. Comments can be submitted to the PUC at this link or by sending an email to the PUC at [email protected].

When submitting a comment, mention the docket numbers (in Xcel’s rate case, the docket numbers are 24-320 and 24-321) so the PUC can attach your comment to the correct case. Even a short, clear comment about affordability, reliability, and renewable investments count.

Rate cases matter because they directly affect your monthly utility bill. Xcel Energy expects that the increases requested will cost the average residential consumer $165 annually. Public scrutiny is the only real check on monopoly utility behavior, and the PUC needs to hear how you would be affected by rising bills and unreliable sources of generation.