Much of the discussion around the “One Big Beautiful Bill” (OBBB) has centered around its reforms to Medicaid eligibility but, of course, the bill contained much else — it was “Big,” after all.

Indeed, the OBBB makes the most significant legislative changes to federal tax policy since the Tax Cuts and Jobs Act (TCJA) which was passed back in 2017. It makes the individual tax changes first enacted in the TCJA permanent, avoiding a tax hike on an estimated 62% of tax filers in 2026. In addition, it adds new tax cuts, including new deductions for tipped and overtime income — not everything in it is “Beautiful” — an expanded child tax credit and standard deduction, and permanence for 100% bonus depreciation and domestic research and development (R&D) expensing.

What might all this mean for you? To answer this, the Tax Foundation “has estimated the average change in taxes paid per individual taxpayer under the OBBBA relative to prior law across each state and county from 2026 through 2035.”

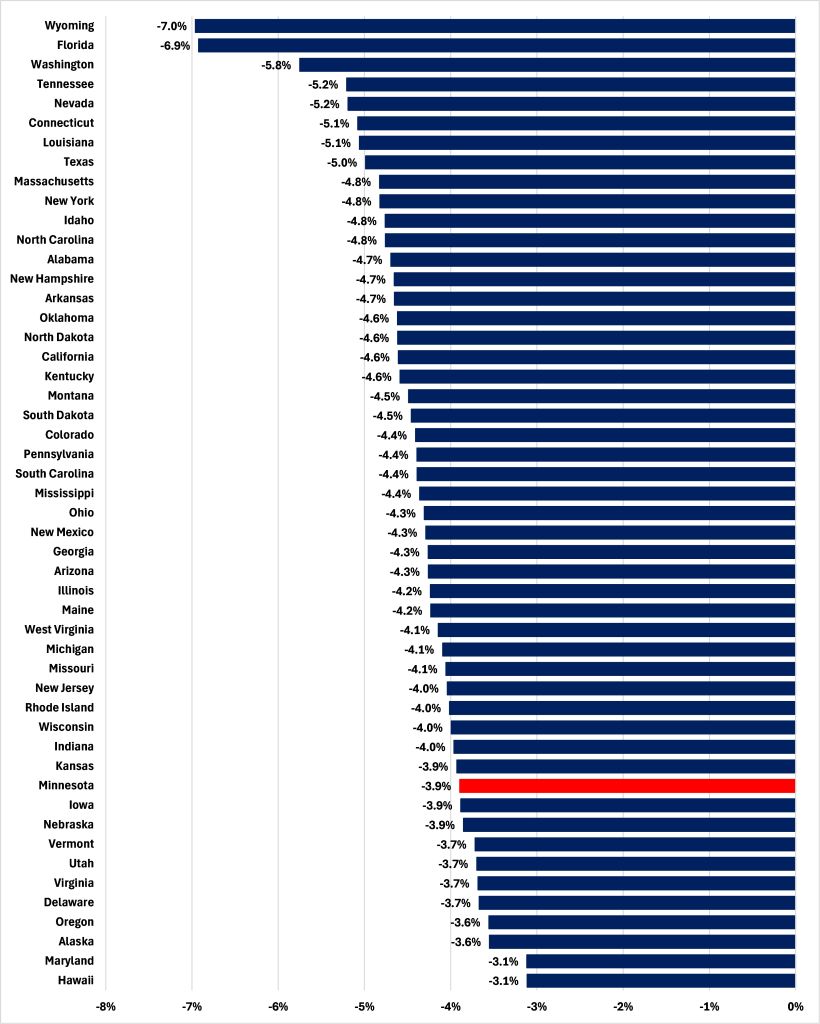

“We estimate the OBBBA will reduce federal taxes on average for individual taxpayers in every state,” the Tax Foundation writes, but notes that there will be considerable variation. “Taxpayers in Wyoming ($5,375), Washington ($5,372), and Massachusetts ($5,139) will see the largest average tax cuts in 2026, while taxpayers in West Virginia ($2,503) and Mississippi ($2,401) will see the smallest average tax cuts that year.” With an average cut of $3,519, Minnesota ranks 30th out of the 50 states, but it has a higher average income than many. If we look at the estimated 2026 tax cut as a share of 2023’s median household income, our state’s 3.9% ranks above just nine states, as Figure 1 shows.

Figure 1: Estimated 2026 income tax cut as a share of 2023 median household income

Looking ahead, the Tax Foundation notes that “The average tax cut falls to…2030 as certain individual changes like deductions for tips and overtime income expire, before rising again up to…2035 as inflation increases the nominal value of the permanent tax cuts.” Now the federal government’s focus must turn to out of control spending.