The Chicago Public Schools board is set to vote on the district’s 2025-2026 budget on Aug. 28. It must close a $734 million budget hole, but the district’s finances are a mess.

Chicago Public Schools leaders must approve a budget plan for the 2025-2026 school year by Aug. 28, but a $734 million budget hole must be handled.

Here’s what you need to know about the financial pitfalls facing the district before board members vote on the budget.

CPS’s long-term debt burden is $9.1 billion

The CPS long-term debt burden is $9.1 billion as of fiscal year 2026. While CPS does not repay that entire debt in 2026, the district will be spending $15.257 billion by 2049 when future interest payments are included.

In fiscal year 2026, CPS plans to refinance $1.8 billion of its debt and add $600 million in new debt for capital projects. CPS will also be taking $65 million from its debt service stabilization fund to help close its budget gap.

CPS’ credit rating is junk

CPS’ credit rating is considered non-investment grade speculative, or “junk,” according to the big three credit ratings agencies: Fitch Ratings and Standard & Poors rate it as BB+ and Moody’s rates it as Ba1.

Notably, countries such as Azerbaijan, Columbia, Morocco, Oman and Vietnam all have the same credit rating as CPS. Serbia and Hungary, among many other nations, have a better credit rating.

Why does it matter? A lower credit rating means that financing terms are more expensive for CPS compared to other government entities with better credit ratings.

The Chicago Teachers Pension Fund is underfunded by $13.9 billion

The Chicago Teachers Pension Fund manages the pensions of over 96,000 members. But as of June 30, 2024, it has $13.9 billion in unfunded liabilities. The funding ratio – which measures how well a pension plan can meet its future obligations – was at 48.1%, up from 47.2% in 2023. To put that in perspective, actuaries often consider systems with funded ratios below 60% to be “deeply troubled” and 40% to be the point of no return.

The debt the Chicago teachers pension owes its workers was $26.2 billion, but they only have enough money to cover $12.3 billion. Even those figures rely on assumptions that have historically proven to be incorrect and underestimate teachers pension debt.

In other words, for every dollar the pension owes to workers, it only has about 48 cents on hand. That means benefits for future workers are at serious risk because a few years in a recession or bad stock market performance could create a situation where the pension doesn’t have enough money to pay its workers at a given time.

CPS’ largest revenue source is property taxes

CPS receives $4.01 billion in property taxes – the largest source of revenue for the district.

The district has two property tax levies. One is a normal education property tax levy that is subject to state law limits and is used to fund normal operations. The district routinely increases its property tax levy by the maximum allowed under Illinois’ Property Tax Extension Limitation Law. It also gets 55% of any excess funds from tax increment financing districts from the city and uses those property-tax generated funds to supplement its budget.

The second is a dedicated levy to raise funds to cover the required Chicago Teacher Pension Fund. The CTPF levy began in 2017 and is a flat rate based on what the district needs to pay into the pension fund, representing $559 million of the $4 billion total levy.

The new CTU contract will cost the district an extra $1.5 billion over the next four years

The vast majority of the new cost is teacher pay raises, with expenses on current teacher salaries expected to grow at least $1.1 billion and up to $1.25 billion, depending on future inflation rates. The average teacher currently earns $86,439. That salary will jump by nearly one-third to $114,429 by the end of the upcoming contract – a nearly $28,000 raise in four years.

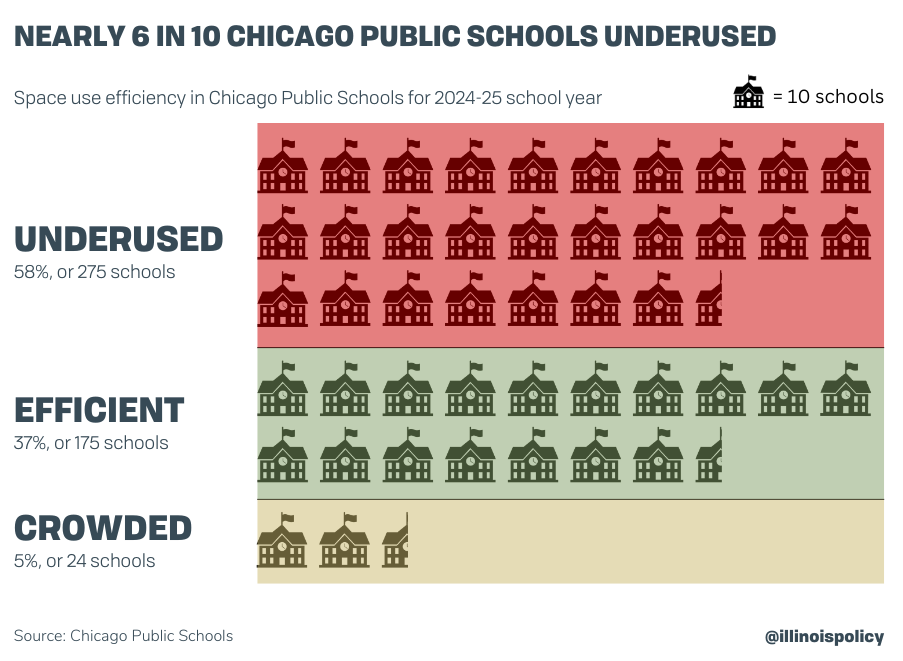

More than 1-in-3 desks are empty in CPS

On average more than 1-in-3 desks is empty within CPS following years of declining enrollment, according to data from the 2024-2025 school year.

Space utilization is measured annually by the district and reported into one of three categories: underutilized, efficient or overcrowded. Data shows 58% of schools – or 275 school buildings – are underutilized. The average school in CPS has 35% of its seats empty.

Closing the district’s $734 million budget hole is no easy task for the CPS board. But the district’s financial wellbeing is dependent on financially sound decisions in the upcoming budget vote.