Last month, we debunked several property tax myths that some local officials are using to shift the blame for their unaffordable tax increases, and now there are two more excuses to address.

For years, many local officials tried to blame County Clerks for setting mill rates, saying something along the lines of ‘we just set our budgets, and then the County Clerk sets the mill rate.’ While technically true (until 2021, see below), it’s like trying to blame your weight gain on the drive-thru clerk when you’re the one ordering the large order of fries and an XL milkshake. County Commissioners and City Council members decided how much property tax they wanted to consume in their budgets, and the Clerk calculated the mill rate to be used.

It was deceptions of this nature that prompted the passage of the Revenue-Neutral / Truth in Taxation in 2021. In fact, the call to “Bee Honest,” is still being used because opponents of additional reforms persist with duplicitous statements.

Now, any elected official who still tries to pass the buck knows they are being dishonest because the revenue-neutral law requires them to vote on the exact mill rate they use to fund their budget.

Blaming the Legislature for “unfunded mandates” and high property tax

Blaming the Legislature for “unfunded mandates” is another common deception used by some local officials. Yes, the Legislature requires local governments to have certain basic services like law enforcement, district courts, property appraisal, and a public health department, but the amount spent on those services is left to local officials.

The amount that elected officials choose to spend on services varies considerably, and that is the most significant factor in how much property tax you must pay.

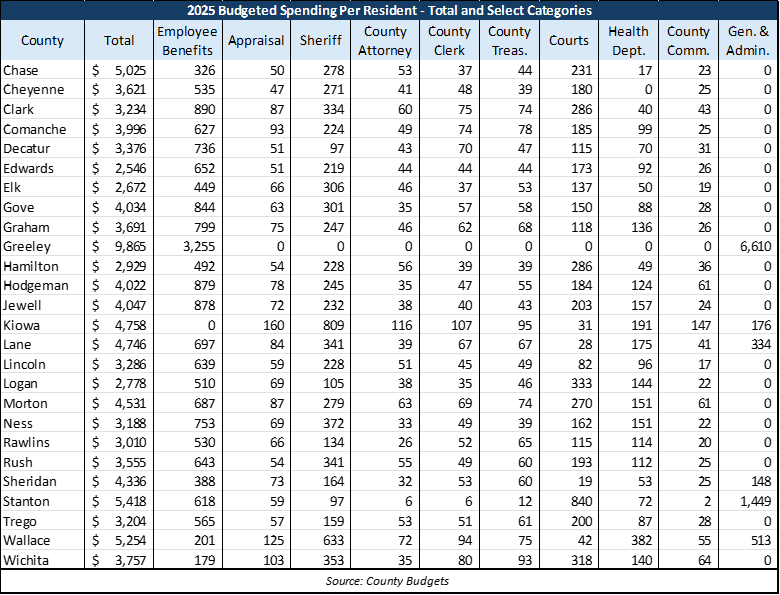

To demonstrate the point, the table below compares the per-resident spending of counties with fewer than 3,000 people. Total spending excludes transfers and cash reserves that some counties list as unspecified spending.

Spending per resident ranges from a low of $2,546 in Edwards County to as much as $9,865 for Greeley County; the median spending is $3,724. The amount spent on capital outlay can temporarily boost spending for some, but most of the difference is merely what local officials choose to spend. The range for per-resident spending on Employee Benefits, for example, goes from as little as $179 to more than $3,000. (Greeley County spends the most, but that may be an inaccurate budget, which lists only two spending categories: General & Administrative and Employee Benefits. This lack of transparency should not be allowed.)

The median spend on Sheriff is $247 per resident in Graham County, but Stanton County reports just $97 while Kiowa County spends $809. (Kiowa County reports spending nothing on Employee Benefits, but that surely is just another reporting issue that should not be allowed.)

It’s important to understand that in all of our research, we’ve not found a single city, county, school district (or even the State of Kansas) having a real budget process. Instead, they have an appropriations process, where each agency or department asks for an increase over the previous budget. How money was actually spent or whether it was spent efficiently or effectively is never a consideration.

The staff presents the ‘budget’ to local elected officials with nowhere near the necessary time or detail to analyze proposals, hoping for a quick approval.

Politicians trying to blame someone else for high property tax reminds me of a skit by the late comedian Flip Wilson’s character named Geraldine, proclaiming, “The devil made me do it.”

It’s not the devil or anyone else who is responsible for your high property tax; it’s the elected officials who approve budgets.