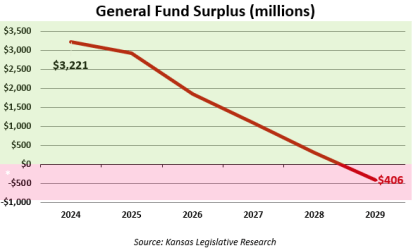

How do you go from having a $3 billion budget surplus and stable tax revenue to broke in just a few years? By repeatedly spending more than you take in.

General Fund spending has pretty much been out of control since 2018, the year after the Legislature passed the largest tax increase in state history. There was a brief dip in 2022 during the Great Recession; however, spending subsequently exploded.

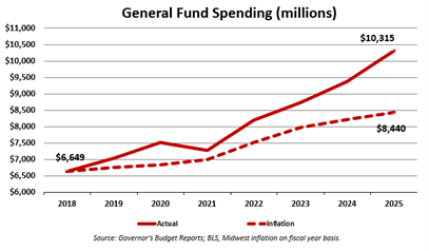

General Fund spending has pretty much been out of control since 2018, the year after the Legislature passed the largest tax increase in state history. There was a brief dip in 2022 during the Great Recession; however, spending subsequently exploded.

Spending would have been approximately $8.4 billion in FY 2025 (the year ended June 30) if it had merely increased in line with inflation, but actual spending was $10.9 billion. That’s a 64% jump over seven years, while inflation was 27%.

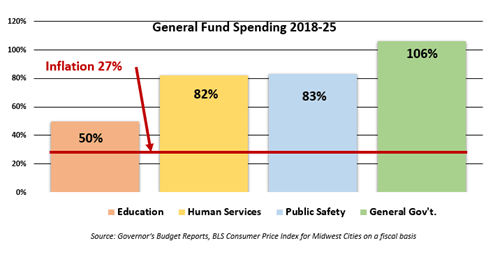

So where did the money go? Education spending, including K-12 and universities, is 50% higher, and that’s the smallest increase of the major spending categories. Human Services, which includes social services and health expenditures, is 82% higher, and Public Safety (mostly correctional facilities) increased by 83%. The largest increase of 106% is for General Government (administration, judiciary, legislature, etc.).

Spending by agency for each year is available at KansasOpenGov.org.

Deficits on the horizon

Democrats blame Republicans for excessive spending, pointing out that Republicans passed budgets with most Democrats voting ‘no.’ Capitol insiders, however, know that most Democrats did so because the giant hikes weren’t enough; they wanted Medicaid expansion, more money for education, etc., and they didn’t propose any spending reductions to pay for their proposals. We can dispense with the finger-pointing because pending deficits are very much bipartisan.

Kansas Legislative Research Department (KLRD) forecasts spending will continue to increase, based mostly on expectations for education and social services. KLRD also predicts relatively stable revenues, but revenue is still far less than expected expenditures, so that Kansas is expected to run budget deficits each year. That will work temporarily because there is still a surplus left over from prior years, but the General Fund will be technically broke by FY 2029. There would still be about $2 billion in the Budget Stabilization Fund, but that is supposed to be for actual emergencies like a deep recession or a terrorist attack like 9/11.

Most politicians say they want government to spend money more efficiently, but do they mean it? In many cases, the answer is ‘no’ when it comes time to take action.

As detailed in our 2012 book, What Was Really the Matter with the Kansas Tax Plan, there were multiple options to reduce spending with efficiency measures during the Brownback deficit years, but Democrats and Republicans alike (as well as Governor Brownback) wouldn’t adopt them, The Legislature adopted a performance-based budgeting law in 2015 that is supposed to identify efficiency opportunities, but Brownback didn’t force his agency heads to comply, and Governor Kelly has done the same. Indeed, as we reported in 2023, 65 state agencies didn’t even bother reporting any measure…let alone if the measure was improving or not.

The solution is simple: notify agencies that budgets will be reduced by 5% annually until PBB is followed with fidelity.

The experience of other states shows that spending can be reduced without cutting services. Every state provides the same basket of services (education, social services, etc.), but some do so at a much lower cost per resident.

For example, our 2025 Green Book shows that the 41 states with an income tax spent 72% more per resident than the nine states that do not tax income ($6,000 per resident compared to $3,479). Kansas spent $5,428 per resident, or 56% more than the states without an income tax.

Using the Tax Foundation’s most recent ranking of combined state and local tax burdens (as a percentage of income, from 2022), we find that the ten states with the highest combined burden spent 87% more per resident than the ten states with the lowest burdens ($6,829 per resident compared to $3,661).

The Kansas Legislature needs to shave upwards of $1 billion from the General Fund budget within the next two years to prevent deficits, and it can be done if it starts laying the groundwork now.

Ask probing questions to test sincerity

So far, there are about a half dozen Republicans seeking the 2026 gubernatorial nomination and two Democrats, and while most will probably acknowledge a need to operate more efficiently, we need to know if they really mean it. Taxpayers and enterprising reporters should test each candidate’s budget position with some probing questions.

First, establish the basis for your questions with something like, “General Fund spending jumped more than twice the rate of inflation since 2018, and now we are facing a deficit shortly.”

Then ask, “Do you propose a tax increase or spending reduction to avoid the coming deficit?” If anyone tries to dodge the question with something along the lines of ‘the wealth should pay their fair share, ask them to define fair share.

“Do you mean that the top earners should pay a share of income tax that’s proportionate to their income? The last time I checked, Kansans with taxable incomes over $250,000 accounted for about a quarter of all the income, but they paid about a third of the income tax. What’ not fair about that?”

Ask those who take the budget option to avoid deficits, “Many states with lower taxes spend a lot less per resident. For example, Kansas spends about $2,000 per resident more than Oklahoma, Missouri, Texas, and Florida. Would you instruct agencies to reduce costs by operating more efficiently?”

Some politicians try to turn the tables on you, saying,” Tell me where you think we should cut. School funding? Social Services?”

Respond with this: “Former Indiana Governor Mitch Daniels said, ‘this place isn’t designed to run efficiently, but that doesn’t mean you can take a cleaver and whack off a big chunk of fat. Like a cow, the fat is marbled throughout the enterprise.’ So let me ask you again, Will you instruct agencies to examine the entire enterprise and reduce costs without cutting services?”

Use this same approach with state legislators, so they know what you expect them to do…and so they know the kind of candidate that gets your vote.