Florida ranks sixth nationally with an overall score of 7.64 in the latest Economic Freedom of North America report published by the Fraser Institute. Based on the most recent data available as of 2023, the report confirms that Florida remains one of the most economically free states in the country. Yet the more revealing signal is not the level of the ranking, but the change in direction. After years near the very top, Florida has dropped slightly.

According to the Bureau of Labor Statistics, Florida has been among the national leaders in job creation since 2020. Employment growth has consistently exceeded the U.S. average, and unemployment rates have generally remained below national levels. These outcomes are exactly what economic theory predicts in a state with no personal income tax and relatively flexible labor markets. Lower marginal tax rates raise after-tax returns to work, while flexible hiring rules reduce adjustment costs for firms.

Output data reinforce the story. The Bureau of Economic Analysis’s state GDP figures show that Florida’s real GDP growth exceeded the national average in 2023, driven by population inflows, construction, tourism, logistics, and business services. Capital follows people, and people follow opportunity. Florida has benefited from both.

During a period of extraordinary population growth, state and local government spending expanded rapidly, outpacing population growth in many jurisdictions. EFNA includes this phenomenon because higher spending today implies higher future taxes or debt service. Even when revenues appear abundant, households and firms respond to expected future tax burdens.

Property taxes provide the clearest channel. While Florida avoids income taxes, local governments rely heavily on property taxes to finance expanding budgets. Property-tax collections rose sharply in many fast-growing regions, raising effective tax burdens even as home values climbed.

Public-sector employment growth reinforces the signal. BLS data show government employment growing alongside population growth. EFNA treats this as a reduction in economic freedom because it signals a larger share of future income devoted to sustaining government rather than expanding private output.

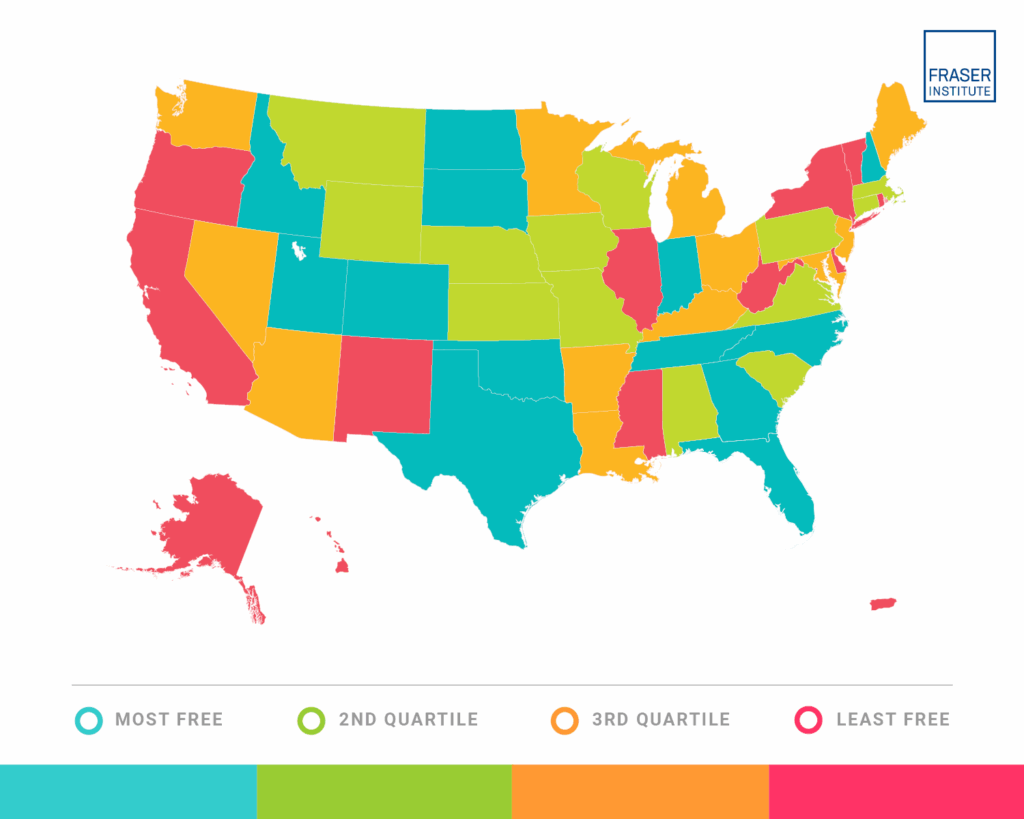

Directionally, Florida’s EFNA ranking slipped slightly after years of stability near the top. That change is small in absolute terms, but meaningful in interpretation. Other states improved their spending discipline while Florida’s government expanded rapidly during the boom. Relative performance determines rankings.

It is also important to understand the timing of the data. The EFNA report relies on 2023 data, meaning recent fiscal restraint or reform efforts are not yet reflected. What is reflected is the cumulative effect of spending decisions made during the height of population inflows. Rankings move slowly because institutions change slowly. That lag is precisely what makes EFNA useful for separating structural trends from short-term political cycles.

The Fraser Institute’s research shows that states with higher economic freedom experience higher incomes, stronger job creation, greater in-migration, and more resilient growth. Florida still enjoys many of those advantages. But the data show that growth can temporarily mask fiscal drift. It cannot erase it.

The economic lesson is straightforward. Economic freedom is preserved not by economic growth itself, but by government spending restraint during growth. When spending expands faster than population and income, future burdens rise even if current revenues are strong. Florida’s slight decline in the rankings is a warning, not a verdict.

Florida’s model remains powerful. No income tax and flexible labor markets continue to attract people and capital. Whether the state climbs back toward the very top will depend on whether government growth is re-anchored to population growth and inflation. Growth can buy time. Discipline determines outcomes.

Vance Ginn, Ph.D., is president of Ginn Economic Consulting, host of the Let People Prosper Show, and previously served as the chief economist of the Trump 45 White House Office of Management and Budget. Follow him on X at @VanceGinn.