For Minnesota teachers, the financial health of the Teachers Retirement Association (TRA) — the single default defined benefit pension plan for the majority of teachers in the state — affects its ability to offer educators the retirement security they have been promised. Unfortunately, the TRA continues to fail to meet its average assumed rate of return (ARR), which results in a double whammy of underfunding teacher pensions and creating public pension debt.

A pension system’s ARR is the rate of return the pension assumes its investments will generate, explains Mariana Trujillo with the Reason Foundation. “It is an investment benchmark determined by a weighted medium-term average expected return for each asset class within a pension portfolio. The assumed return is an essential input for pension contributions and funded estimates.”

The underperformance of investment expectations creates a gap between the TRA’s assumed rate of return and actual investment return — a gap that, under most defined benefit plans, falls on state and local governments (ultimately, taxpayers) to close and “make up the difference to ensure retirees receive the promised pension benefits,” continues Trujillo.

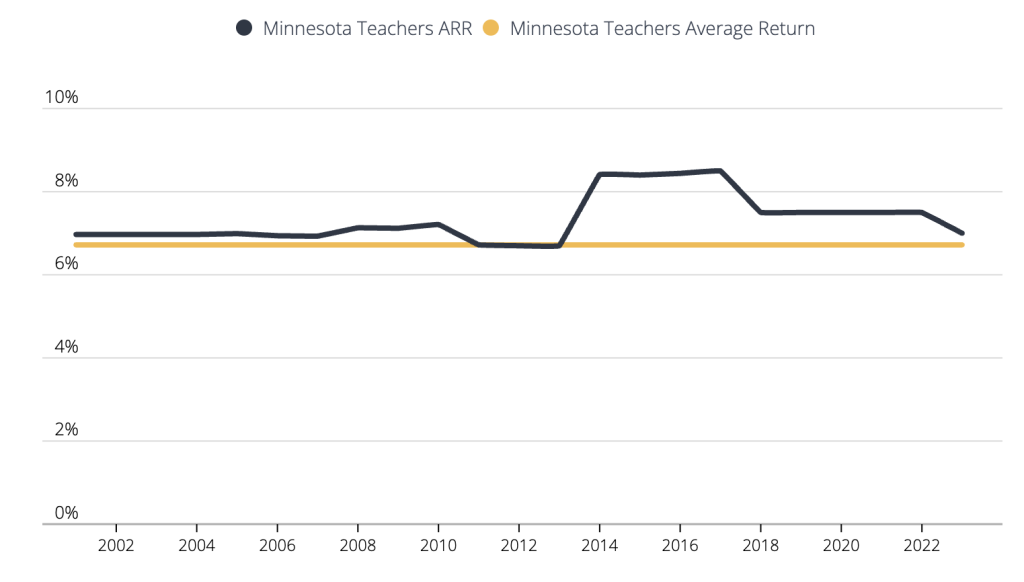

TRA has been overestimating investment returns for a number of years, with its yearly average ARR most out of whack with the average return rate from 2014 to 2017 and still higher from 2018 to 2022. Its 2023 ARR at 7.0 percent more closely approaches the 23-year TRA average return rate of 6.7 percent, according to Trujillo’s analysis.

Yearly Average Assumed Rate of Return and 23-Year Average Return Rate

“Since pension contributions are estimated based on expected returns, when investments underperform expectations, public pension plans end up with less money than they anticipated — creating unfunded liabilities,” notes Trujillo. “…[T]he overestimation of assumed rates of returns not only leads to inappropriately lower present contributions and increased future costs but also creates a potential shock to public financial planning that can surface at any time.”

As I wrote here, the TRA pension fund continues to run a contribution deficiency. This means that actual contributions once again fail to meet the required contributions necessary to fully fund the pension plan.

Actual Contributions Continually Fail to Make the Required Contributions Necessary to Fully Fund Teachers Retirement Association (TRA)

Because TRA is still assuming a return that is higher than its 23-year average, a further downward revision to its ARR is likely imminent, which also means increases in unfunded liabilities and increases in contributions to make up for previous shortfalls.

Such changes to the public pension fund may not be welcomed by all involved but are necessary for its long-term viability so pension promises are kept, financial reporting isn’t misstated, and liability costs aren’t passed on to future taxpayers, concludes Trujillo.

______________

Minnesota teachers, did you know that union membership does not impact your pension? Pensions are not subject to collective bargaining in Minnesota. Union members and non-members have the same pension benefits. Learn more here.