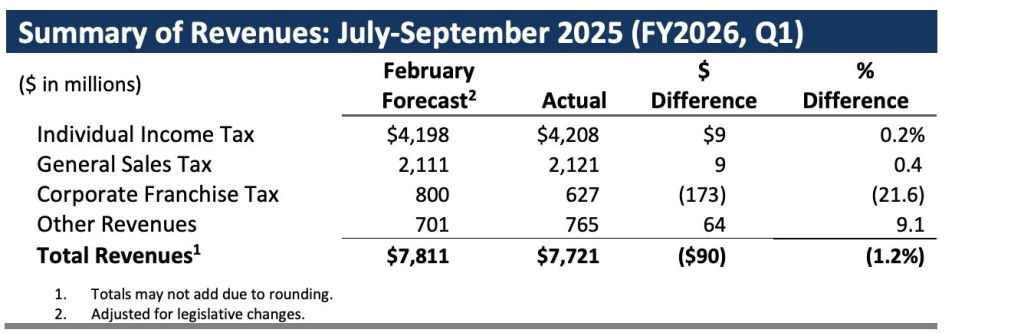

According to Minnesota Management and Budget (MMB), tax collections in the first quarter of the 2026 fiscal year — July to September 2025 — were $90 million below the February forecast. This was entirely due to lower-than-expected corporate income tax collections.

If nothing improves, this could be a preview of the upcoming November budget forecast, which MMB will release early December. If so, this will be a continuation of budget troubles that started in the 2023 session. In 2023, the legislature blew a $18 billion surplus, raised taxes, and launched what are now persistent deficits.

According to the most recent estimates, Minnesota is expected to spend $66.9 billion in the current biennium (fiscal years 2026-27). This is $2.5 billion more than the state will collect in revenue. If revenue collections continue to come below forecast, that gap will only grow.

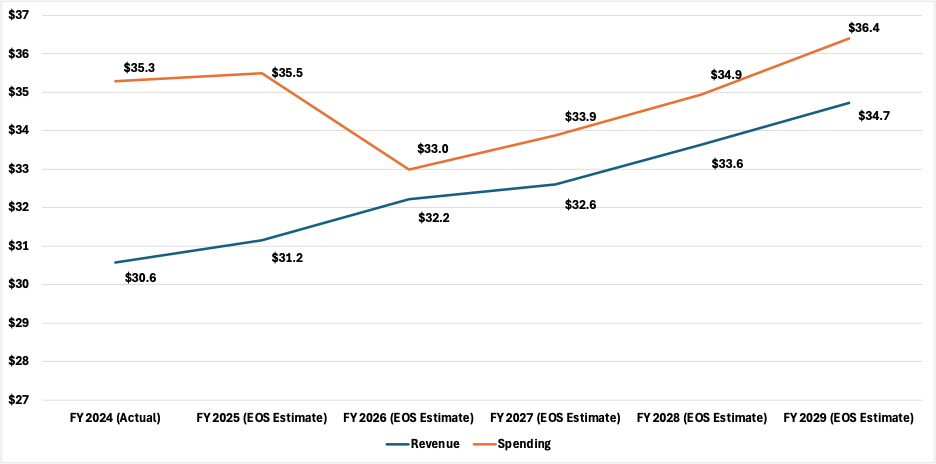

Revenue Vs. Spending, FY 2024 – FY 2029

The good news is that there is over $4 billion left over from the 2024-25 biennium to cover the $2.5 billion gap. But budget issues will continue beyond the end of the 2026-27 biennium, at which point there will be little, if any, surplus funds.

In the 2028-29 biennium, Minnesota will spend $71.3 billion (including inflation). This is $3 billion higher than estimated tax collections. After including leftover funds, that gap shrinks, but the budget is still expected to end with a $1.1 billion deficit.

Worse yet, if Minnesota does not adopt healthcare reforms passed in the One Big Beautiful Bill (OBBA), that deficit will likely grow as the state loses federal matching funds for the Medicaid program.

A long-term problem

To put it simply, the Minnesota state budget is in trouble.

Every year between 2024 and 2029, spending will exceed revenue collections, evidence that the state is spending beyond its means. Any unforeseen crises — such as lower-than-expected tax collections or federal spending cuts — are bound to worsen Minnesota’s budget outlook.

The current sour revenue update should be a reminder to lawmakers that, in the 2026 legislative session, reform is necessary for the future sustainability of the state budget.