Turns out, even shutting down the government for three weeks does not save taxpayers money. According to the U.S. Treasury Department, federal debt reached $38 trillion on Wednesday this week. This amounts to over $110,000 per U.S resident (based on 2024 population numbers).

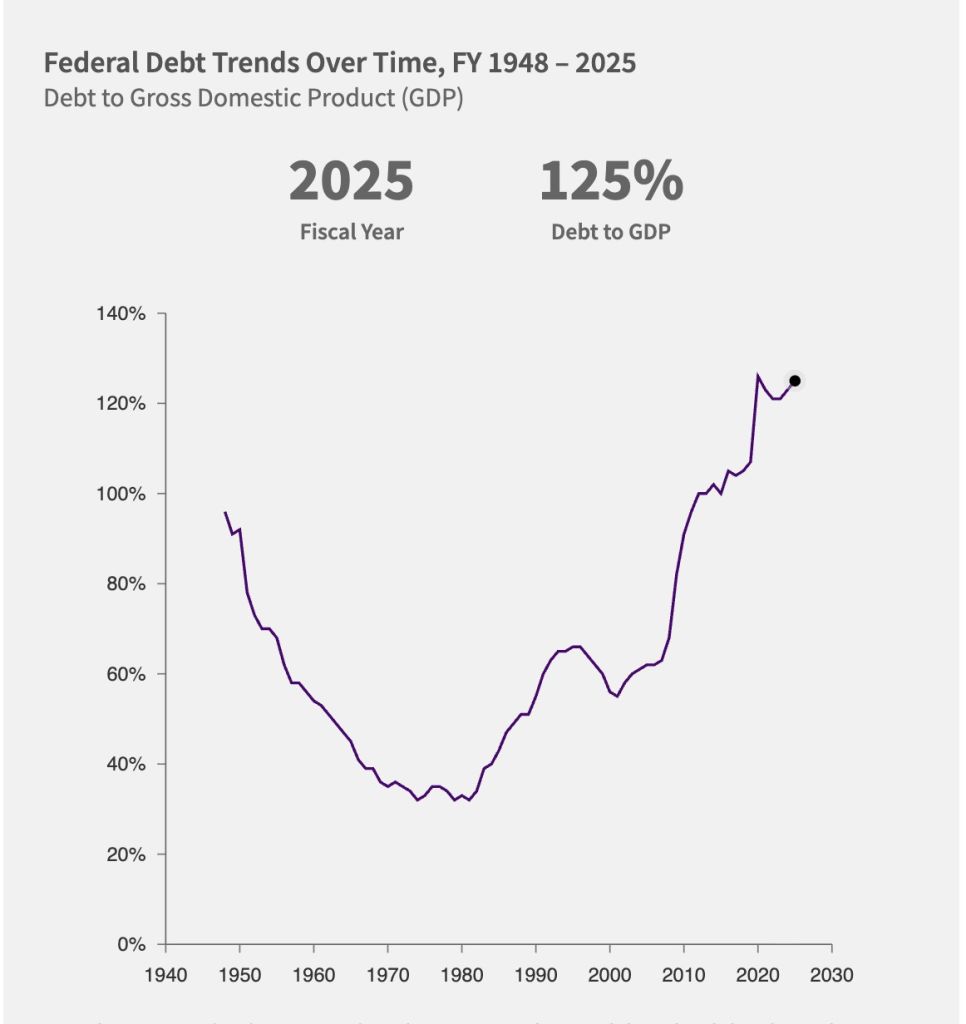

At the end of the 2025 fiscal year — October 2024 to September 2025 — debt reached $37 trillion or 125 percent of the size of the U.S. economy. This is the highest level in history, surpassing World War 2 levels when debt surged to 106 percent of GDP. Excluding debt held by other government entities, debt held by the public reached 100 percent of GDP.

What’s driving debt? Mainly, entitlement spending.

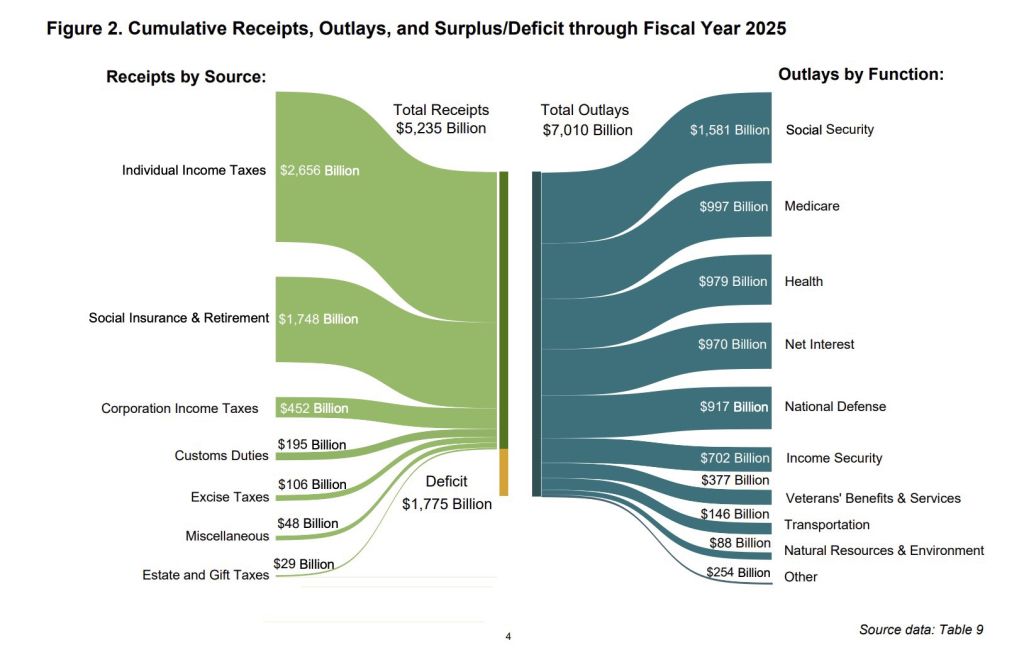

The federal government spent $7 trillion in the 2025 fiscal year but collected $5.2 trillion in revenue, meaning a $1.8 trillion deficit. Entitlements — Social Security, Medicare, Medicaid, and other benefits— accounted for half of all spending. Interest payments took another 14 percent, and defense was 13 percent of the budget.

Medicare, Social Security, and Medicaid are on autopilot, and so is the budget. Between 2025 and 2035, the three programs could grow from 11 percent of GDP to nearly 13 percent of GDP. Debt held by the public could reach $52 trillion, or 119 percent of GDP.

This is problematic for a number of reasons.

As borrowing grows, so will interest rates. This will mean two things, both equally unpleasant. First, taxpayers will send trillions to Washington, D.C. every year, not to pay for healthcare or roads, but to service debt. Interest payments are expected to grow from $970 billion in 2025 to $1.8 trillion in 2035. Second, high interest rates mean higher borrowing costs for businesses and households, whether for mortgages, financing cars, or expanding businesses.

Shutdown theatrics won’t address debt

Certainly, it is commendable that Republicans in Congress are drawing a line in the sand and rightly refusing to extend health insurance subsidies for wealthy people.

However, a more important discussion needs to be had: the national debt is high and rising. This is mainly due to Medicare and Social Security. If left unaddressed, growing debt will have severe consequences for the budget and the entire U.S economy.