New data shows that in a nation where teachers often stock their own classrooms, parents and community members are stepping in to fill the gap.

For example, Minnesota spent $16,900 per student during the 23-24 academic year, placing it near the upper end of state spending. But Minnesota’s teachers can face empty classrooms and bare supply closets. In what has become a yearly tradition, crowdfunding sites like GoFundMe and Donors Choose are flooded with campaigns to stock classrooms. Some districts have found more creative ways to gain supplies. In St. Cloud, a partnership between a rotary club and a local philanthropist couple led to a program called Ready, Set School. At Talahi Community School, a school where more than 90 percent of students qualify for free and reduced lunch, and all kindergarten through third grade students at Talahi Community School receive school supplies for the year at no cost to families. Additionally, all preschool students in the district receive school supplies for the year.

In 2022, a national EdChoice survey found that 77 percent of teachers spent their own money on classroom supplies.

Schools function as an essential aspect of statebuilding, creating an opportunity for citizens to invest heavily in the knowledge and wellbeing of the newest generation. In more feudal times, noblemen felt a type of noblesse oblige, or a responsibility to use their privilege to benefit others. Our more egalitarian era would say that the noblesse oblige should be felt by every citizen, as the work of democracy requires a universal spirit of generosity.

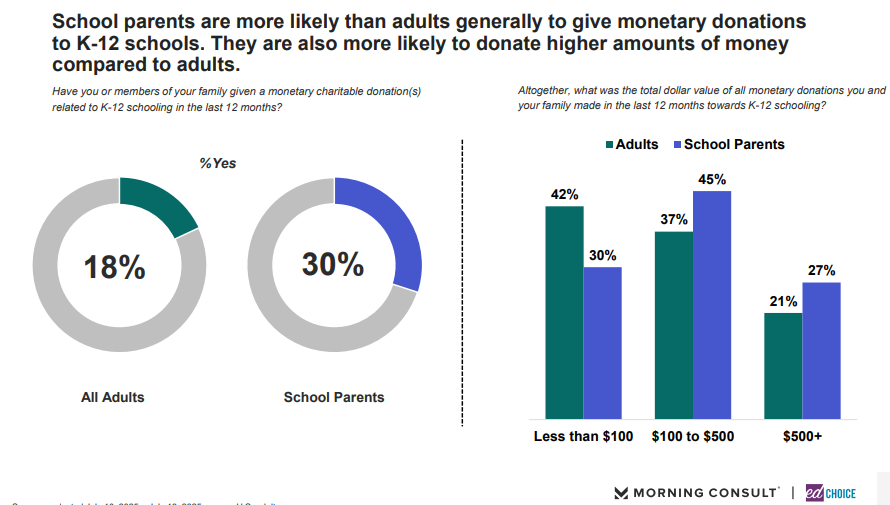

While required state taxes and additional measures like local bond votes preemptively mandate this type of generosity from each citizen, some go beyond these obligations. Interestingly, new data from a Morning Consult poll, given in partnership with EdChoice, suggests that almost one in five adults donate to K-12 schools. Perhaps unsurprisingly, parents of school age children are more likely to donate — almost one in three parents donated to K-12 schooling in the past year.

So, who are these donors? Are they largely blueblooded private school types, making donations worthy of a name plaque?

Not at all. The data shows that the majority of donations sent to schools by all adults are in the low range (less than $100) and the majority of donations sent by parents are in the mid-range ($100 to $500).

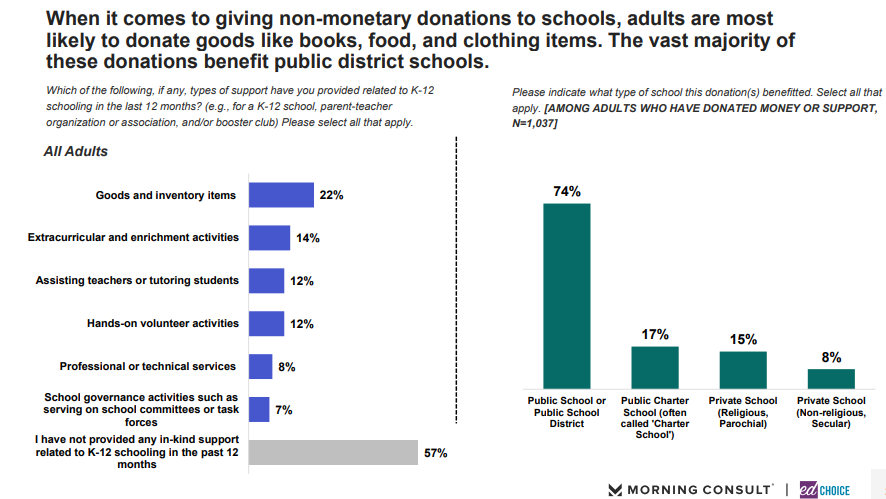

Surprisingly, the majority of school donations were not earmarked for private schools. 74 percent of donations were sent to public schools or public school districts. Most school support came from parents providing goods or inventory items.

While higher-income families (making more than $100,000 per year) were more likely to donate money to schools (48 percent of families donated), donations came from middle income (34 percent) and lower income (18 percent) families as well.

While there were some differences across racial, geographic, and political affiliations, most sub-groups surveyed were in step with one another’s donation patterns. With regards to ethnicity, Hispanics were the most likely to donate to schools, with 40 percent of Hispanics donating. At 38 percent, urban families donated more than suburban families (26 percent), small town families (31 percent), or rural families (24 percent).

These statistics highlight a national tension. The cultural expectation for public schools is that they will be well-funded and freely accessible, as educational funding comes from tax dollars. However, many public school teachers and administrators find deficits in their budget, leading to public requests for additional funding and generous donations from parents and community members. As my colleague Catrin Wigfall has noted, the solution for schools does not always come from a budget increase. How money is spent is always more important than the depths of the coffers.

While these statistics show a promising level of civic involvement, they also portray a discouraging need for additional donations beyond mandatory tax dollars. As Minnesota looks towards the future of its education system, it is to be hoped that budgets can be reexamined to ensure that community donations are signals of additional investment, not charitable pity.