Kansas Representative Shannon Francis (R-Liberal) told KSNT-TV that he thinks higher property taxes may be bringing people to Kansas. He said higher property taxes have led to investment in schools, and that, as a result, “Kansas schools are a lot better than Oklahoma.”

It may be intuitive to think that more spending translates to better outcomes, but the data show otherwise, with Kansas and Oklahoma being perfect examples.

An 8-score composite of the 2024 National Assessment of Educational Progress (NAEP) reading and math results shows very similar outcomes for Kansas and Oklahoma: the Kansas composite score of 243 is one point better, both states have 36% of students below basic in reading and math, and Kansas has 28% average proficiency compared to 26% for Oklahoma.

An 8-score composite of the 2024 National Assessment of Educational Progress (NAEP) reading and math results shows very similar outcomes for Kansas and Oklahoma: the Kansas composite score of 243 is one point better, both states have 36% of students below basic in reading and math, and Kansas has 28% average proficiency compared to 26% for Oklahoma.

However, Kansas spent almost $20,000 per student in 2023, roughly 32% more per student than Oklahoma, which spent about $15,000. Spending an extra $5,000 per student didn’t make a difference in the outcomes.

Spending data is from the U.S. Census and is adjusted for the cost of living as calculated by the Missouri Economic Research and Information Center (MERIC) in our 50-state analysis.

Nine states (Utah, Florida, North Carolina, California, South Carolina, Nebraska, Washington, Texas, and New York) each have a 246 composite score, while the per-student spending ranges from $11,953 (Utah) to $29,486 (New York).

There simply is no evidence that spending more money produces better student outcomes. Money can make a difference if effectively spent, but just spending more doesn’t raise proficiency levels.

By the way, property tax reform also won’t impact school funding because schools are funded by a formula based on enrollment. Property tax is one of the funding sources, but the funding allowed through the formula is not diminished if schools collect less property tax; the difference would be offset with other state funding sources.

Seward County needs property tax reform

Property tax reform is a hot topic in the City of Liberal and Seward County, and with good reason.

Between 1997 and 2024, property taxes to fund the county, cities, and other entities except schools increased by 145%, with inflation at 85%. Next year will be rough on taxpayers, with Seward County Commissioners voting 3-2 to raise taxes by 33% over this year.

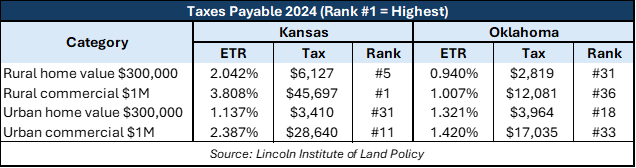

Property taxes are much more affordable in Oklahoma, according to the Lincoln Institute of Land Policy’s 50-state analysis. For example, the tax on a home valued at $300,000 in rural Kansas would, on average, be over $6,000; the effective tax rate of 2.042% is the fifth-highest in the nation. The tax on that same home in rural Oklahoma would only be about $2,800.

The tax on a $1 million commercial business with $200,000 in fixtures would be over $45,000 in rural Kansas, which has the highest effective tax rate in the nation on rural commercial property. The tax on that business in Oklahoma is only about $12,000. It’s hard to imagine that people would choose to move to Kansas to pay so much more in property taxes.

The Kansas House and Senate are considering two major property tax reforms: limiting the increase in taxable assessed property value to 3% annually, and allowing voter input on the mill increase above revenue-neutral, like a direct vote to approve or a protest petition to stop an excessive increase.

Kansans can express their support for these reforms by emailing their senators and representatives at BeeHonestKansas.com.