Neutral testimony from the Kansas Association of Counties on the proposed 3% valuation assessment limit says, “The major benefit for taxpayers is predictability,” and notes that predictability could also help counties by having fewer disputes over valuations. Sedgwick County Commissioners, on the other hand, are taking a ‘sky is falling’ approach replete with scare tactics and at least one false claim thrown in for good measure.

Limiting the increase in taxable assessed valuation does not violate state constitutional principles, as the Commissioners claim. Residential property, for example, has an assessment ratio of 11.5%, meaning it is taxed at 11.5% of its appraised value. Commissioners are telling legislators that limiting the increase in taxable assessed value means some homes will have effective assessment ratios below 11.5%, and that this violates the Constitutional requirement for a “uniform and equal basis of valuation.”

Limiting the unaffordable increase in a home’s taxable basis does mean it will be taxed at less than 11.5% of its appraised value, but Sedgwick County Commissioners are overlooking (or ignoring) one key factor: SCR 1616 amends the constitution to allow this. The changes proposed in SCR 1616 couldn’t be made in statute because of the ‘uniform and equal’ provision, but the constitution can be amended to protect property owners from unaffordable valuation spikes.

Jay Hall, the attorney representing the Kansas Association of Counties, didn’t raise any constitutional concerns, and neither did the League of Kansas Municipalities, which also testified neutral on SCR 1616.

Assessment limits have been around for decades

Assessment limits have been around in many states for a long time. If assessment limits produced significant negative economic consequences, opponents of SCR 1616 would use that data to make their case. But in the absence of any proof to explain their opposition, they resort to scare tactics.

Sedgwick County Commissioners are among those who say that assessment limits will have housing market consequences, without providing evidence that such issues occurred in states with assessment limits. If the proof existed, they would provide it rather than unfounded, scary predictions.

Sedgwick County needn’t raise mill rates to maintain services

Threatening service cuts or rate increases is another favorite scare tactic to push back against property tax relief, and Sedgwick County claims it would need a large mill rate hike “to maintain current services” if valuations are rolled back to 2022 levels (which is another popular feature of SCR 1616).

The Sedgwick County budget tells a different story, however.

The Financial Forecast for All County Property-Tax Supported Funds predicts annual revenues and expenditures out to 2030. A few of the interesting highlights include:

- A 50% increase in property tax revenue over the 2022 actual amount collected.

- A 55% increase in pay and benefits for county employees.

- The Ending Fund Balance goes from an unnecessary $110 million to an even more inflated $127 million.

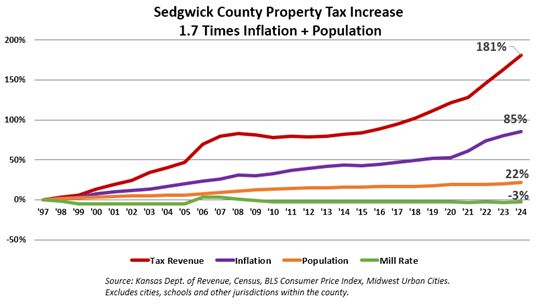

County Commissioners already raised property taxes nearly double the combined rates of inflation and population, and their financial forecast makes it worse over the next few years. It doesn’t have to be that way.

Nearly half of the counties in Kansas did not raise property taxes last year. They held their revenue-neutral rates and found ways to provide services more efficiently, and Sedgwick County could do so as well.

Taxpayers can’t wait years to deliberate over a complete system overhaul

Commissioner Jim Howell is pushing an 11-point plan to overhaul the property tax system, and he has some good ideas. The problem is that it would take many years to get passed and implemented, and people are being taxed out of their homes today.

Over the last three years for which data are available (2021 to 2024), the average Kansas homeowner saw a 26% increase in property taxes, while inflation-adjusted per capita personal income declined by 3%.

A realtor from Ellis told the Senate Tax Committee that she heard from three Kansans in the last week who are facing the same reality: a couple with serious medical issues who can’t predict their next property tax bill, an elderly woman who may soon have to sell her home, and a young family considering leaving the state — all because of rising property taxes.

A realtor from Ellis told the Senate Tax Committee that she heard from three Kansans in the last week who are facing the same reality: a couple with serious medical issues who can’t predict their next property tax bill, an elderly woman who may soon have to sell her home, and a young family considering leaving the state — all because of rising property taxes.

Stories like these are common across many Kansas communities. People need protection from unaffordable valuation spikes NOW by limiting the increase in taxable assessed values.

Of course, some elected officials could choose to increase mill rates rather than hold them steady and operate more efficiently. Those who oppose an assessment limit correctly note that, in such cases, properties with valuation increases below 3% would pay slightly more than they would otherwise.

No one has ever disputed the possibility, but the answer isn’t opposing assessment limits. The Legislature should also limit mill rate increases beyond a certain limit without voter approval. Look for ways to ensure success for taxpayers rather than excuses to kick the can down the road and allow more people to be taxed out of their homes.

Republicans and Democrats in the Legislature should listen to their constituents, who overwhelmingly support assessment and mill rate limits because they know the combination will make property taxes more affordable.