Earlier today, Minnesota Management (MMB) released the November 2025 budget forecast. Some good news, MMB forecasts a $2.5 billion surplus for the 2026-27 biennium. This is up from the $1.9 billion estimated at the end of the 2025 legislative session. But that is where the good news ends.

Despite the rhetoric, Minnesota’s budget position is anything but solid, and that has been true since the end of the 2023 legislative session. While better than it was during the February 2025 forecast, Minnesota’s fiscal position is worse than it was at the end of the 2025 legislative session.

Here is a look at the state’s persistent and widening structural deficit.

The growing structural deficit

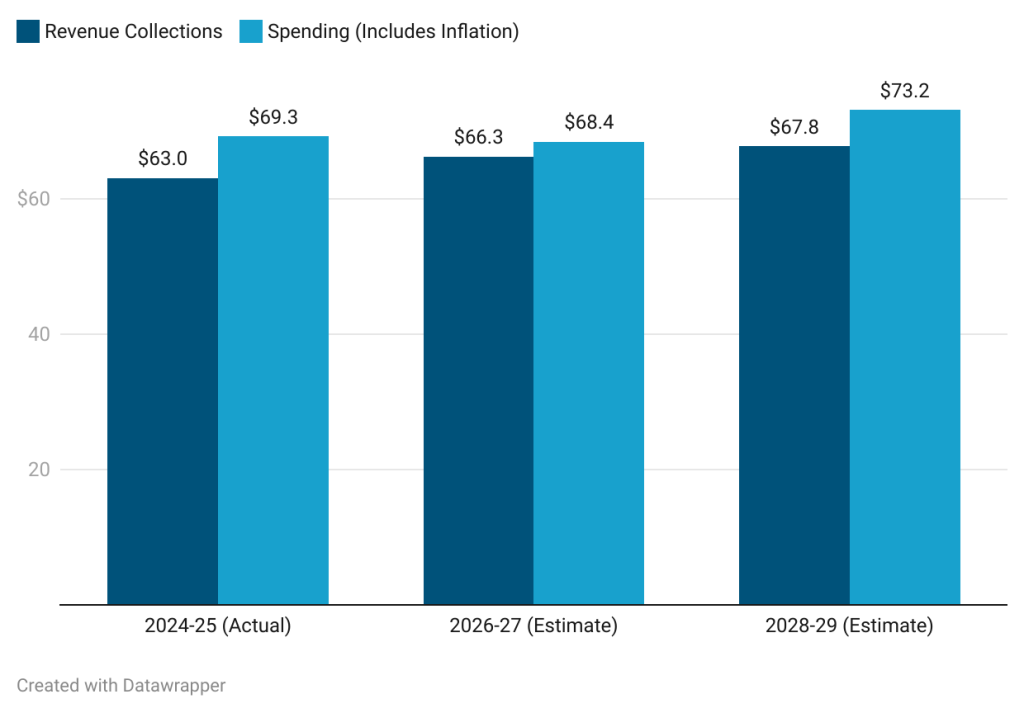

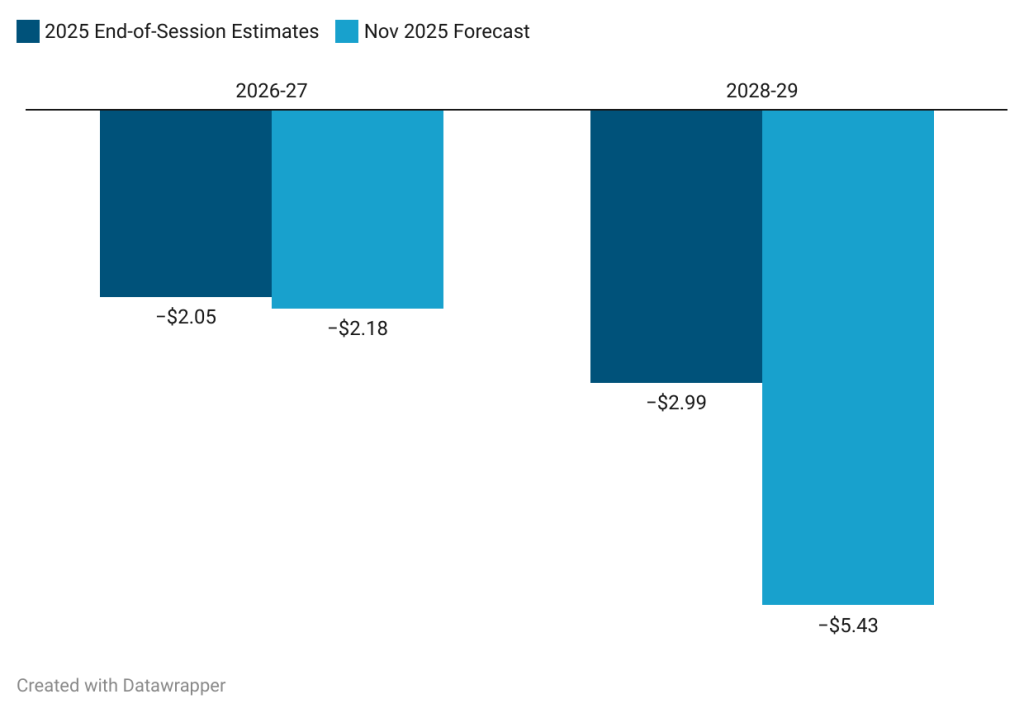

In February, MMB estimated that, including inflation, Minnesota would spend $68 billion during the 2026-27 biennium. This was $3.3 billion more than the state was expected to collect during the same period. Spending cuts enacted in the 2025 legislative session cut that structural imbalance to $2 billion. However, due to increased spending, the November 2025 forecast shows a $2.2 billion gap between revenues and spending for the 2026-27 biennium. That is, the structural deficit has grown by over 100 million dollars.

Similarly, for the 2028-29 biennium, MMB expects Minnesota to spend $73.2 billion after including inflation. This is $5.4 billion more than the state will collect in revenue. At the end of the 2025 session, however, the structural deficit stood at $3 billion. After excluding inflation, spending will exceed revenues by $4.5 billion, which is more than double the structural deficit estimated at the end of the 2025 session. While the structural deficit will be cut in half due to some leftover funds from the 2026-27 biennium, MMB estimates a $3 billion budgetary deficit during the 2028-29 biennium.

Figure 1: Revenue collections vs. Spending, November 2025 Budget Forecast (Billion $)

Figure 2: Structural Deficit (Includes Inflation), End-of-Session Estimates Vs. November 2025 Forecast (Negative Billion $)

Medicaid is still leading spending growth

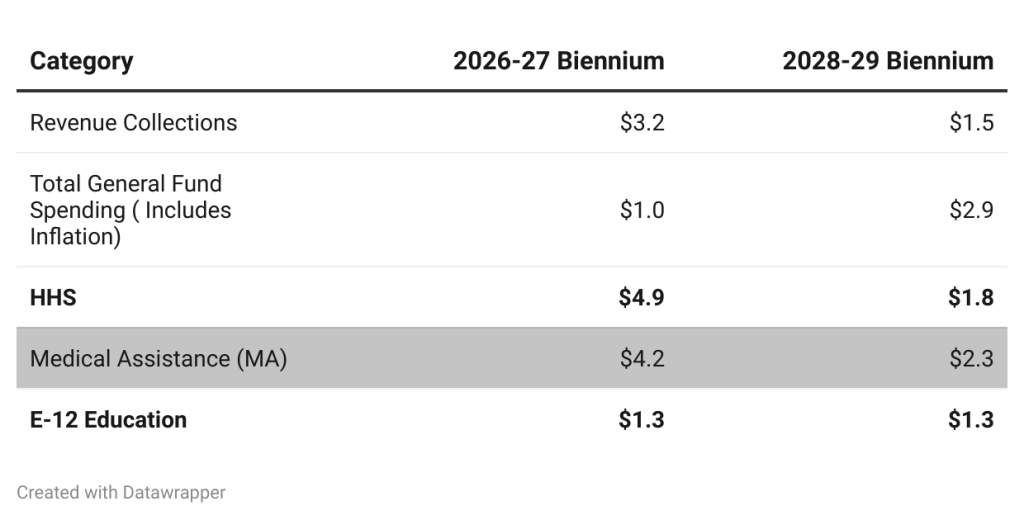

Medicaid or Medical Assistance (MA), which accounts for the majority of welfare or Health and Human Services (HHS), is the leading cause of growth, a trend that has persisted since the end of the 2023 session. HHS spending will total $25.8 billion in the 2026-27 biennium, nearly $5 billion higher than what Minnesota spent during the 2024-25 biennium, and $1.8 billion higher than what was estimated at the end of the 2025 legislative session. Medicaid (MA) will account for 86 percent of that growth.

For the 2028-29 biennium, HHS will surpass K-12 education and become the largest expenditure in the state budget. HHS will grow by $1.8 billion compared to the 2026-27 biennium and reach $27.6 billion in the 2028-29 biennium. Medicaid will grow by $2.3 billion between 2026-27 FY and 2028-29 FY, accounting for nearly 80 percent of general fund spending growth.

Revenues will grow during the 2026-27 FY and the 2028-29 fiscal years. However, Medicaid will consume more than 100 percent of any new funds the state government will collect during that period.

Table 1: Nominal growth from the previous biennium (Billion $)

More reform is necessary

Minnesota’s widening structural deficit, despite rising revenues, is proof of a worrying trend that American Experiment has noted over the last two years: the state budget is on an unsustainable path. This is mainly a result of the 2023 legislative changes, which accelerated growth, particularly in Long-Term Care (LTC) waivers.

In addition to rooting out fraud, legislators will need to reform formulas in LTC waivers to slow growth. As Minnesota’s population ages and healthcare prices continue to rise, spending on long-term care services will also continue to grow, increasing pressure on state resources.